|

This page offers information for Residents pursuing electrification projects (homeowners and renters). Information for non-residential entities (including developers, business owners, and non-profit organizations) can be found here!

|

Getting Started

Various funding resources are available to help you electrify your home. Rebates, tax credits, and loans can often be combined when you make a purchase of a new energy-efficient system or appliance, making it easier to offset the initial cost and shortening the payback time.*

*Note: Financing and tax programs frequently change. Consult your installer or tax professional for the most up-to-date information. Also, be sure to confirm that your appliance model qualifies. Keep in mind that many installers may not yet know about all available incentives -- we're working to help them too.

Incentives: reduce the cost of electrification projects

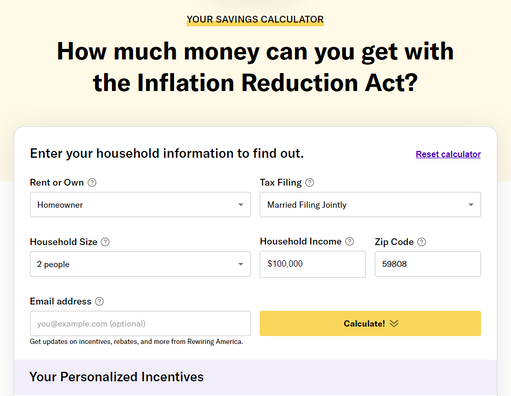

The Inflation Reduction Act of 2022 (IRA) included new and expanded federal tax credits and up-front rebates for electric appliances, energy efficiency and clean energy! These incentives can be often stacked with existing utility rebate programs and state or private low-interest loan options. Your household's financial situation (and other factors) will determine which incentives you can use.

|

Ready to dive in?

Tax credits - available now!

Federal tax credits worth 30% of project costs (up to certain annual limits depending on the technology) apply to:

Ready for a tax miniguide to share with your contractor or tax professional? Click here. The Montana DEQ also has great information on federal tax credits here. Rebates

Local rebate programs - available now

Income-qualified rebates - coming soon For low- and moderate-income households, the IRA includes rebates that cover up to 100% of the up-front costs for certain energy efficiency and electrification projects, plus electric appliances such as induction stoves/cooktops and heat pump clothes dryers (up to certain annual limits). Rebate programs will be administered at the state level; details are still being finalized, with availability anticipated by late 2024. (Note: The state may change the final rebate amounts offered, which may differ from the amounts shown on the IRA calculator above.) |

Learn More About IRA:For more information about the Inflation Reduction Act (IRA), check out these resources:

|

Financing Options

If paying the full upfront cost of electrification is not in the cards, there are several local low-interest loan options to affordably finance your project.

|

Montana Alternative Energy Revolving Loan Program (AERLP)

The Montana Department of Environmental Quality's AERLP provides low-interest loans to individuals, small businesses and nonprofit organizations. This loan program is primarily intended to finance renewable energy (e.g. rooftop solar), but can also be used to finance energy efficiency & electrification projects that are completed in conjunction with or at about the same time as a renewable energy system. This includes insulation, high-efficiency windows, and energy-efficient appliances including heat pumps, water heaters, electric stoves, washers/dryers and more. This is a great option for combining solar and energy efficiency/ electrification projects under a single low-interest loan.

|

Clearwater Credit Union Energy Efficiency & Solar Loans

Clearwater Credit Union offers two loan products that support home electrification and clean energy projects. Interest rates are subject to change; see Clearwater website for most updated rates and loan terms. Home Energy Efficiency Loan: Eligible projects include upgrading HVAC, windows, doors, appliances, air and ground source heat pumps, mini splits, EV wiring, and insulation.

Home Solar Loans: unsecured loan for solar panels; can be reamortized after receiving state or federal incentives to lower monthly payments.

|

Financial Resources by System Type

Browse below to find the financing resources that can best assist in electrifying your home or business!

Resource |

Requirements |

Link |

Ground source heat pumps (Space Heating)

|

NorthWestern Energy customers qualify for a rebate of up to $2,500 per system.

|

|

|

Missoula Electric Cooperative customers may qualify for an incentive for installing a new ground source heat pump.

|

|

|

Montana's Alternative Energy Revolving Loan Program (AERLP) provides low-interest loans to increase investments in alternative energy systems and energy conservation measures in Montana. It may be used by individuals, small businesses and nonprofit organizations.

This is a great option for combining solar and energy-efficiency/electrification projects under a single low-interest loan! |

The AERLP loan program is primarily meant to finance renewable energy (e.g. rooftop solar), but can also be used to finance energy conservation projects that are completed in conjunction with or at about the same time as an alternative energy system, with the intention of reducing the size of that system. This includes:

|

|

ENERGY STAR-rated ground source heat pumps qualify for the Federal Energy Efficient Home Improvement Credit of 30% of equipment and installation costs, up to $2000.

|

|

Later in 2023 or early 2024: Stay tuned for details about rebates that will reduce the up-front cost for low- and moderate-income families for energy-efficient appliances, including heat pumps for space and water heating.

Air source heat pumps (Space Heating)

|

NorthWestern Energy customers qualify for ENERGY STAR-rated Air Source Heat Pumps rebates of between $100-$150/ton for existing homes.

|

|

|

Missoula Electric Cooperative customers may qualify for a monetary incentive for installation of a new Air Source Heat Pump.

|

|

|

ENERGY STAR-rated air source heat pumps qualify for the Federal Energy Efficient Home Improvement Credit of 30% of equipment and installation costs, up to $2000.

|

|

|

Montana's Alternative Energy Revolving Loan Program (AERLP) provides low-interest loans to increase investments in alternative energy systems and energy conservation measures in Montana. It may be used by individuals, small businesses and nonprofit organizations.

This is a great option for combining solar and energy-efficiency/electrification projects under a single low-interest loan! |

The AERLP loan program is primarily meant to finance renewable energy (e.g. rooftop solar), but can also be used to finance energy conservation projects that are completed in conjunction with or at about the same time as an alternative energy system, with the intention of reducing the size of that system. This includes:

|

Later in 2023 or early 2024: Stay tuned for details about rebates that will reduce the up-front cost for low- and moderate-income families for energy-efficient electric appliances, including heat pumps for space and water heating.

Heat Pump Water heaters

|

Missoula Electric Cooperative customers are eligible for a rebate of $600 – $900 for qualified installations of heat pump water heaters which replace existing electric storage water heaters.

NorthWestern Energy customers are eligible for a $3,000 incentive to cover costs if switching from an existing electric water heater to a heat pump water heater. |

|

|

ENERGY STAR-rated heat pump water heaters qualify for the Federal Energy Efficient Home Improvement Credit of 30% of equipment and installation costs, up to $2000.

|

|

|

Montana's Alternative Energy Revolving Loan Program (AERLP) provides low-interest loans to increase investments in alternative energy systems and energy conservation measures in Montana. It may be used by individuals, small businesses and nonprofit organizations.

This is a great option for combining solar and energy-efficiency/electrification projects under a single low-interest loan! |

The AERLP loan program is primarily meant to finance renewable energy (e.g. rooftop solar), but can also be used to finance energy conservation projects that are completed in conjunction with or at about the same time as an alternative energy system, with the intention of reducing the size of that system. This includes:

|

Later in 2023 or early 2024: Stay tuned for details about rebates that will reduce the up-front cost for low- and moderate-income families for energy-efficient electric appliances, including heat pumps for space and water heating.

aPPLIANCES

|

NorthWestern Energy customers qualify for rebates up to $100 for various ENERGY STAR and highly energy-efficient home appliances, including washers, thermostats and air purifiers.

|

|

|

Missoula Electric Cooperative customers qualify for up to $50 rebates for ENERGY STAR-rated washers and dryers.

|

|

|

Montana's Alternative Energy Revolving Loan Program (AERLP) provides low-interest loans to increase investments in alternative energy systems and energy conservation measures in Montana. It may be used by individuals, small businesses and nonprofit organizations.

This is a great option for combining solar and energy-efficiency/electrification projects under a single low-interest loan! |

The AERLP loan program is primarily meant to finance renewable energy (e.g. rooftop solar), but can also be used to finance energy conservation projects that are completed in conjunction with or at about the same time as an alternative energy system, with the intention of reducing the size of that system. This includes:

|

Later in 2023 or early 2024: Stay tuned for details about rebates that will reduce the up-front cost for low- and moderate-income families for energy-efficient appliances, including heat pump clothes dryers, electric induction stoves & cooktops.

wEATHERIZATION & Efficiency

|

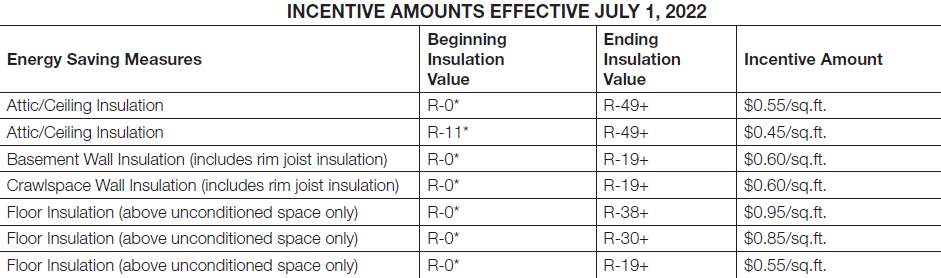

NorthWestern Energy customers may qualify for incentives of up to $1.00/sq.ft for various insulation types and investments.

|

|

Missoula Electric Co-op offers rebates for insulation and window replacement.

|

|

|

Montana's Alternative Energy Revolving Loan Program (AERLP) provides low-interest loans to increase investments in alternative energy systems and energy conservation measures in Montana. It may be used by individuals, small businesses and nonprofit organizations.

This is a great option for combining solar and energy-efficiency/electrification projects under a single low-interest loan! |

The AERLP loan program is primarily meant to finance renewable energy (e.g. rooftop solar), but can also be used to finance energy conservation projects that are completed in conjunction with or at about the same time as an alternative energy system, with the intention of reducing the size of that system. This includes:

|

|

The Federal Energy Efficient Home Improvement Credit covers 30% of equipment and installation costs (up to $1200 annually). This includes:

|

|

Later in 2023 or early 2024: Stay tuned for details about rebates that will reduce the up-front cost for low- and moderate-income families for insulation, air sealing, and efficient windows and doors.

|

Low-income families may qualify for the Department of Energy's Low Income Weatherization Assistance Program, which in Missoula county is administered by the Human Resource Council. This program allows approved applicants to have qualified professionals conduct energy audits and weatherization improvements on their residences, free of charge.

|

Annual household income limits apply, depending on household size

|

Electrical Service & Panel upgrades

Electrifying older homes may require upgrading your electrical service and/or electrical panel to accommodate increased electricity usage.

The Federal Energy Efficient Home Improvement Credit covers 30% of the cost of upgrading your electrical panel, up to $600, when done in conjunction with another energy efficiency upgrade under the same credit (e.g., heat pump or heat pump water heater).

If upgrading electrical service in conjunction with installing solar panels, this 30% credit is uncapped.

See Rewiring America's information on Electrical Panel upgrades for more details.

If upgrading electrical service in conjunction with installing solar panels, this 30% credit is uncapped.

See Rewiring America's information on Electrical Panel upgrades for more details.

Later in 2023 or early 2024: Stay tuned for details about rebates that will reduce or fully cover the up-front cost for low- and moderate-income families for electrical panel upgrades.