|

This page offers information for non-residential entities (including developers, business owners, and nonprofit organizations). Click HERE for information for Residents (homeowners and renters).

|

Getting Started

Various funding resources are available to help you electrify your business or nonprofit building. Rebates, tax credits, and loans can often be combined when you make a purchase of a new energy-efficient system or appliance, making it easier to offset the initial cost and shortening the payback time. Head to our What to Electrify page to read about different types of systems and make your own plan for electrification.

*Note: Financing and tax programs frequently change. Consult your installer or tax professional for the most up-to-date information. Keep in mind that many installers may not yet know about all available incentives -- we're working to help them too.

Incentives: reduce the cost of electrification projects

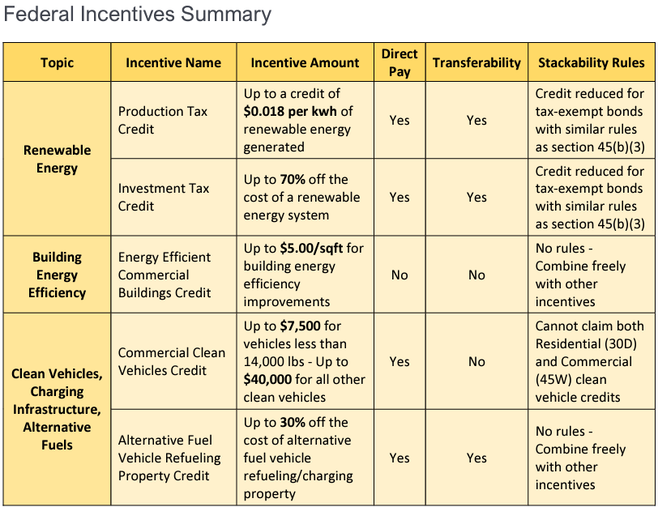

The Inflation Reduction Act of 2022 (IRA) included new and expanded federal tax credits for clean energy and energy efficiency for businesses, nonprofits, and local government. These incentives can be stacked with existing utility rebate programs and state or private low-interest financing options. We're still learning in this area, so stay tuned for more to come!

Tax credits - available now!

Inflation Reduction Act's new direct pay and transfer options allow more organizations to utilize clean energy tax credits for equipment placed in service on or after January 1, 2023 and through December 31, 2032:

Inflation Reduction Act's new direct pay and transfer options allow more organizations to utilize clean energy tax credits for equipment placed in service on or after January 1, 2023 and through December 31, 2032:

- Direct Pay: Through the direct pay option, the value of certain tax credits can be distributed as a direct payment to non-taxable entities, such as tax-exempt organizations, states, political subdivisions, and rural electricity co-ops.

- Transferability: Transferability allows eligible taxpayers, that are not tax-exempt entities, to transfer all or a portion of certain tax credits to an unrelated party. This is particularly helpful for households and businesses that may not have adequate tax burden to otherwise benefit from the full value of the credit.

More financing options

Commercial Property Assessed Capital Enhancements (C-PACE)

Enabling legislation for C-PACE was recently passed in 2021 and communities across Montana are working through their local city or county governments to participate in the program. Once your community has elected to participate, commercial property owners can opt-in to the C-PACE program, which can cover up to 100% of the total up-front cost of their renewable energy or energy efficiency projects. Then, they can pay back those costs through bi-annual assessments on their property taxes. To learn more about C-PACE, and its implementation in your community, visit our C-PACE page and LastBestPace.com.

USDA Rural Energy for America Program (REAP)

Eligible technologies: solar, wind, hydro, biomass, geothermal, energy efficiency

The U.S. Department of Agriculture’s Rural Energy for America Program (REAP) provides grants to qualifying agricultural and small businesses for 25% of the cost of a renewable energy project, up to $500,000. Energy efficiency grants and loan guarantees are also available through the program. Small businesses must be located in a qualified rural area; agricultural businesses may be located in either a rural or non-rural area. For more details, click here or contact Karl Sutton at Mission West Community Development Corporation, the local liaison for this program.

Alternative Energy Revolving Loan Program

Eligible technologies: solar PV, solar thermal, wind, micro-hydro, geothermal, certified pellet/wood stoves.

The Alternative Energy Revolving Loan Program (AERLP) provides zero-down, low interest loans of up to $40,000 to individuals, small businesses, nonprofit organizations and government entities in order to increase investments in alternative energy systems and energy conservation measures in Montana. The program is managed by the Montana Department of Environmental Quality’s Energy Office. Eligible technologies include solar PV, solar thermal, geothermal, EPA-certified low-emission pellet or wood stoves, wind, and micro-hydro. Energy conservation measures may be included in a loan when installed in conjunction with an alternative energy system. For program terms and an application form, click here.

Universal System Benefit (USB) Incentives

Eligible technologies: solar PV, small wind, hydro, and others considered as appropriate

NorthWestern Energy administers Universal System Benefits (USB) incentives through its E+ Renewable Energy Program to qualifying non-profit organizations, government agencies, and schools in NorthWestern’s Montana service territory. Projects receiving these funds often provide civic value including education and visible representation of renewable energy technologies to a broad audience. For more information, click here.

Enabling legislation for C-PACE was recently passed in 2021 and communities across Montana are working through their local city or county governments to participate in the program. Once your community has elected to participate, commercial property owners can opt-in to the C-PACE program, which can cover up to 100% of the total up-front cost of their renewable energy or energy efficiency projects. Then, they can pay back those costs through bi-annual assessments on their property taxes. To learn more about C-PACE, and its implementation in your community, visit our C-PACE page and LastBestPace.com.

USDA Rural Energy for America Program (REAP)

Eligible technologies: solar, wind, hydro, biomass, geothermal, energy efficiency

The U.S. Department of Agriculture’s Rural Energy for America Program (REAP) provides grants to qualifying agricultural and small businesses for 25% of the cost of a renewable energy project, up to $500,000. Energy efficiency grants and loan guarantees are also available through the program. Small businesses must be located in a qualified rural area; agricultural businesses may be located in either a rural or non-rural area. For more details, click here or contact Karl Sutton at Mission West Community Development Corporation, the local liaison for this program.

Alternative Energy Revolving Loan Program

Eligible technologies: solar PV, solar thermal, wind, micro-hydro, geothermal, certified pellet/wood stoves.

The Alternative Energy Revolving Loan Program (AERLP) provides zero-down, low interest loans of up to $40,000 to individuals, small businesses, nonprofit organizations and government entities in order to increase investments in alternative energy systems and energy conservation measures in Montana. The program is managed by the Montana Department of Environmental Quality’s Energy Office. Eligible technologies include solar PV, solar thermal, geothermal, EPA-certified low-emission pellet or wood stoves, wind, and micro-hydro. Energy conservation measures may be included in a loan when installed in conjunction with an alternative energy system. For program terms and an application form, click here.

Universal System Benefit (USB) Incentives

Eligible technologies: solar PV, small wind, hydro, and others considered as appropriate

NorthWestern Energy administers Universal System Benefits (USB) incentives through its E+ Renewable Energy Program to qualifying non-profit organizations, government agencies, and schools in NorthWestern’s Montana service territory. Projects receiving these funds often provide civic value including education and visible representation of renewable energy technologies to a broad audience. For more information, click here.

Curious about how your energy bill will be affected by switching to Energy Star high efficiency appliances? Check out Energy Star's Savings Calculator Tool.